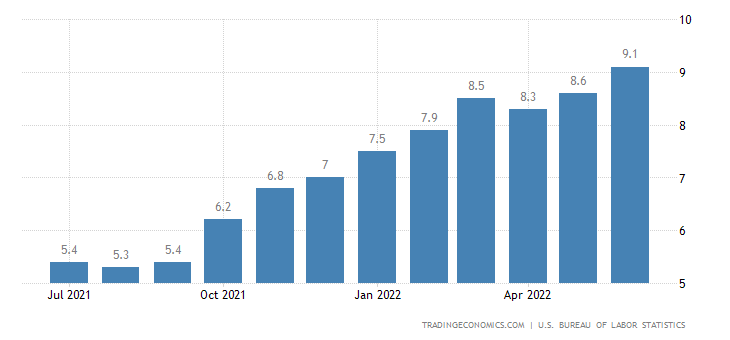

Current Inflation Rates In The United States: 2000-2022

The annual inflation rate for the United States is 9.1% for the 12 months ended June 2022, the largest annual increase since November 1981. This increase follows an 8.6% rise in the previous period and was announced by the U.S. Labor Department on July 13. The next inflation update is scheduled for release on August 10 at 8:30 a.m. ET and will offer the rate of inflation over the 12 months ended July 2022.

The Annual Inflation Rate In The States

Inflation, Consumer Prices (Annual %)

Interest Rate Increase By FED

- Facing the highest inflation in over 40 years, the US Federal Reserve has raised the target range for the federal funds rate by 75 basis points to 1.50-1.75%.

- The current Federal Reserve interest rate, or federal funds rate, is 2.25% to 2.50% as of July 28, 2022. The Federal Reserve raised its core interest rate by 0.75% on July 28. This is the fourth rate hike this year and one of the largest increases in decades as the Fed focuses on fighting inflation levels that are at 40-year highs.

- And that is unlikely to be the end of it – the midpoint of the target range for interest rates could be around 3.4% by the end of the year.

You will find more infographics at Statista

You will find more infographics at StatistaWhat Rising Interest Rates Mean for Multifamily Investors?

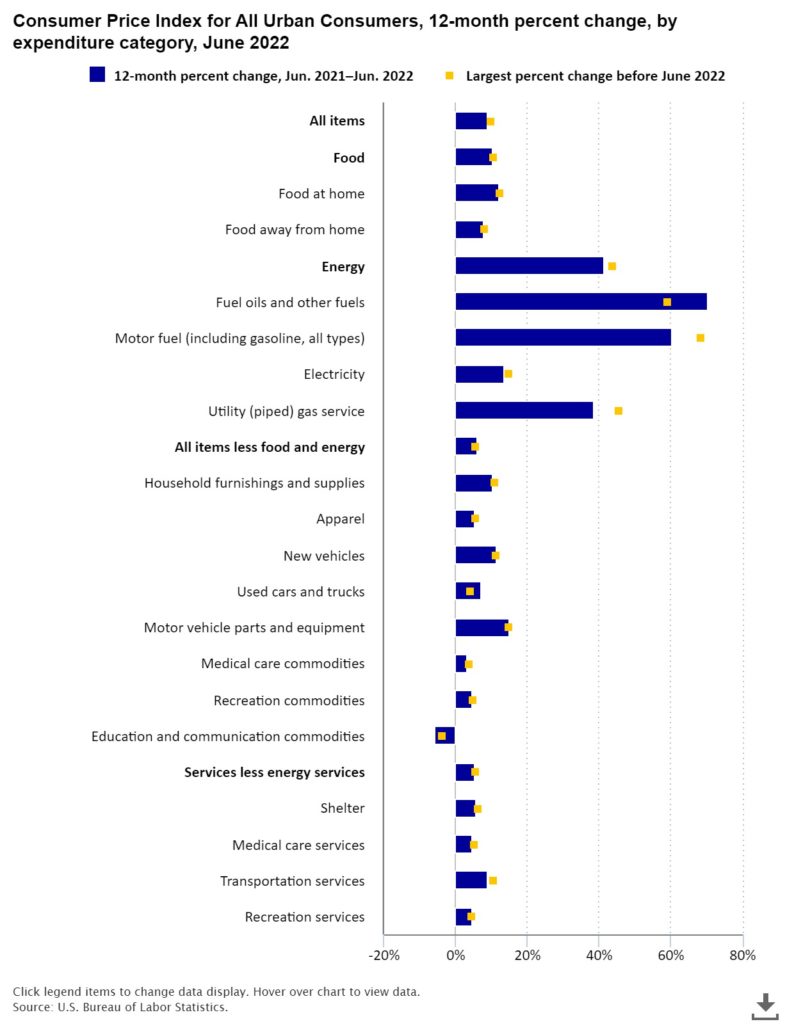

Inflation can be both a boon and a bane for real estate. On the one hand, inflation can act as a tailwind for real estate prices and rents. On the other hand, inflation that is too high for too long will force borrowing costs to rise, thereby, cooling down real estate prices.

According to a new report by property data and analytics firm Yardi Matrix, the national average asking rent rose by $15 in April, up to a new all-time record of $1,659. Year-over-year rent growth fell back slightly in April but remains high at 14.3%.

The high demand for multifamily housing, driven by a lack of available units, migration patterns caused by pandemic-era lifestyle changes, and higher-income renters willing to pay more for the units that are available, has not slowed down because of rising rents.

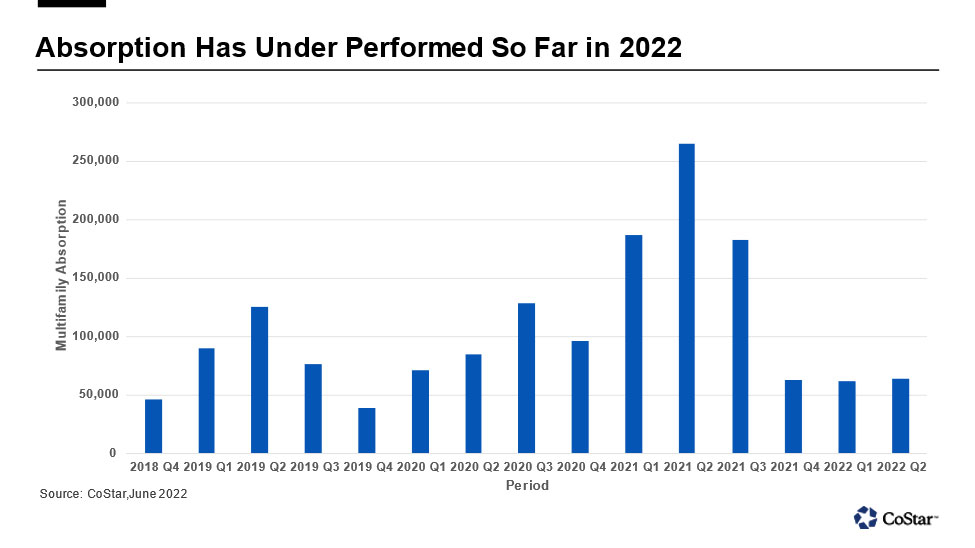

The Increasing Demand For Multifamily Outpaced Supply

High construction costs and rising interest rates can increase the monthly mortgage payments of homebuyers. This may discourage potential homebuyers from buying property and keep more people in the rental market.

Housing analysts estimate that the U.S. lacks between 2 million and 5 million of the housing units it needs, due to a shortage of new developments over the past decade resulting from constraints on land, high labor and material costs, and reduced financing following the Great Recession.

Interest Rates Keeping Up With Rising Inflation

As the population of baby boomers grows and more people look to rent rather than buy, multifamily real estate will be in high demand. This demand can lead to significant rent growth in many markets. For example, Rent.com reports that nationwide rent prices have continued their year-over-year climb. For example, rent for a one-bedroom apartment is up an average of 26.5%, while two-bedroom rents are up 25.7%.

The trend of rising rents is being driven by increased demand for housing due to demographic shifts, including more students graduating college. These demographic shifts are increasing the number of people for whom higher rents are affordable.

Multifamily Leases Are Short Enough To Beat Inflation

Multifamily leases are generally no longer than 12 months long. As leases expire, landlords can attempt to increase rents to existing or new tenants by at least as much as the annual rate of inflation. Although rising rents may lead to stable cash flow for investors, it can potentially result in greater returns for those investors and a potential hedge against inflation.

What Multifamily Investors Should Look Out For?

Multifamily Supply, Demand And Demographic Shifts

The housing market, particularly affordable housing in urban centers, is tight. As the economy opens back up and more people go out, there may be a move from the suburbs to cities for investors to consider. Likewise, more people have moved to the center of the country and are seeking workforce housing.

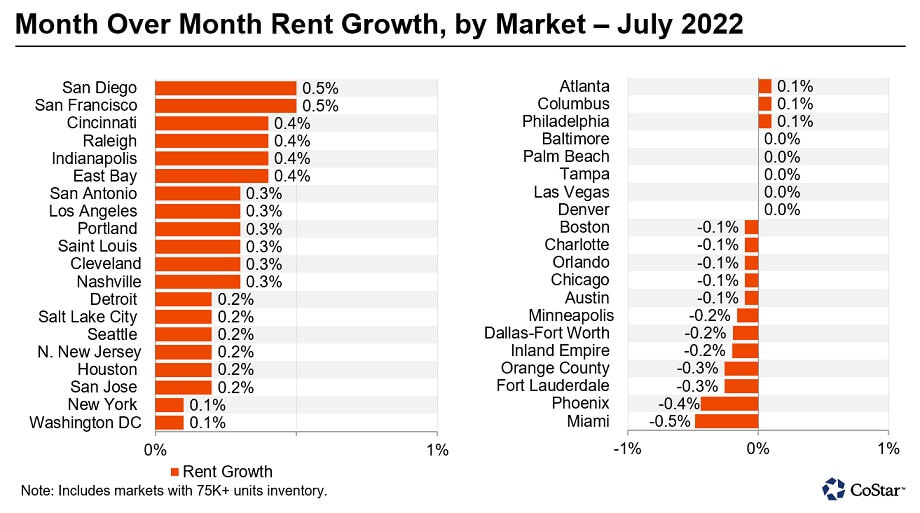

Keep An Eye On Local Markets

Real estate is a local business, so you should take a close look at the specifics of your market before purchasing or refinancing property. It’s also important to evaluate each property’s capitalization rate, which generally goes up when interest rates increase.

Real Estate Financing

When interest rates rise, short-term loans tend to be more affected than long-term ones. Variable-rate financing is also impacted by interest rates. In addition, keep an eye on the 10-year Treasury yield, which helps determine mortgage rates. The yield is also viewed as a sign of investor sentiment about the economy and may reflect higher levels of expected inflation in the long term, whereas falling yields may indicate lower inflation along with a possibility of a slowdown or recession.

Join our investor list to access our current and upcoming investment opportunities.