130 ACRES LAND DEVELOPMENT INVESTMENT OPPORTUNITY

Austin, TX

Solo 401K, SD-IRA, QRP

506C Investment for Accredited Investors Only

Solo 401K, SD-IRA, QRP

506C Investment for Accredited Investors Only

Projected Returns

25%

AAR

1.5x

Equity Multiple

18%

Preferred Return

25%

AAR

1.5x

Equity Multiple

18%

Preferred Return

Investment Overview

PLANNED PROJECT TIMELINE

We are starting with the Phase 1 land entitlement Investment Opportunity. We expect with the combination of buying pre-announcement price to land entitlement within 24 months will create massive investment returns.

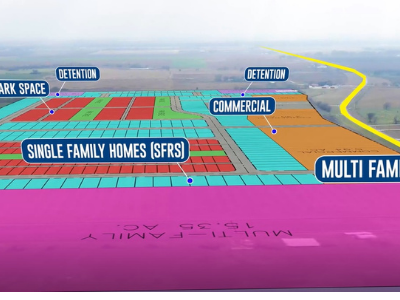

Investors in Phase 1 will receive Rights of First Refusal (ROFR) for Phase 2 and 3. Phase 2 consists of Horizontal construction and Phase 3 consists of vertical construction of 300+ Multifamily, 150+ Build-To-Rent communities, and 450 Single Family Homes.

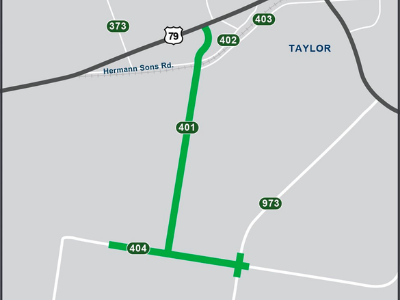

Taylor 130 Acres tract is touching the edge of the Samsung plant tract. This is the closest you can get to the gentrification action in Taylor, TX.

Taylor 130 is located at FM973 which connects to CR404 and the new four-lane South East Loop Hwy. South East loop is a major project that will fuel the gentrification of that area.

Phase 1

Land Entitlement

Phase 2

Horizontal construction

Phase 3

Vertical Construction

Investment highlights

TAYLOR 130 Townhomes Community SUMMARY

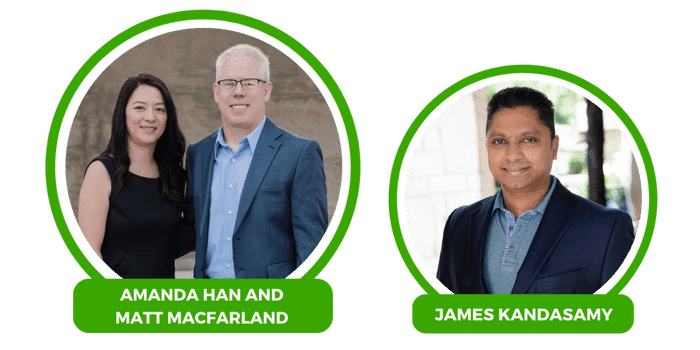

Achieve Investment Group is excited to partner with Epitome Development & Chery Street Investments to present a 130 acre Land Development Investment Opportunity in Taylor, TX within Austin TX MSA. This submarket is the Boomtown within the Boomtown due to Samsung announcement of a $17B Chip Fabrication Plant. the largest direct foreign investment in Texas so far! Keep in mind Apple and Tesla’s recent investment was only $1B. This is 17X bigger !

Phase 1 of this investment is focused on high equity growth with a short-term outlook of just 24 months or less to take advantage of the rapid increase in land value after entitlement due to the anticipated growth in this location. Phase 2 and 3 will lead to the Vertical Construction of 300+ Multifamily, 150+ Townhomes Rental communities, and more than 450 Single Family Homes.

If you think you have missed the real estate boom in the past few years, this is the opportunity that you don’t want to miss. We got a great deal as we were under contract on this land a few months before Samsung announcement.

75K

Minimum Investment

1.5X

Equity Multiple

18%

Preferred Return

25%

Average Annual Return

★ 506(c) offer For Accredited Investors Only ★

Location Overview

Touching The Edge Of The Samsung Plant Tract

located at FM973 which connects to CR404 and the new four-lane South East Loop Hwy

Closely located to North Austin where Silicon Hills is being formed with Apple's $1B campuses

DELL Headquarters, and Tesla Gigafactory.

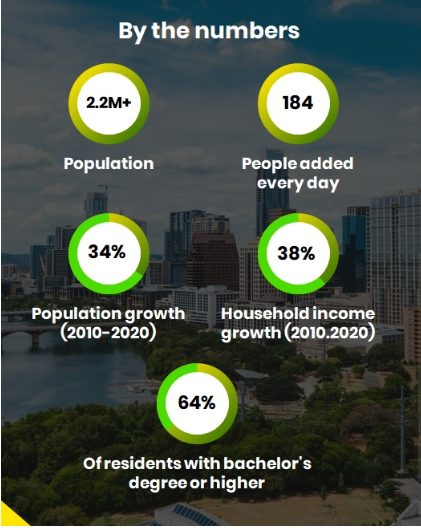

AUSTIN MARKET Overview

Austin Experienced in-migration of roughly 67.200 people between July ’19 and July ’20 – the fastest growth of any metro with at least one million residents (U.S. Census Bureau. May ’21). fueled largely by the city’s expanding employment opportunities. Austin is one of the youngest. smartest, safest. and fastest growing cities in the country. The city’s strong economy, highly educated and talented workforce. globally respected research institutions, and driving entrepreneurial spirit keep it on the leading edge of business. Austin has earned a reputation as one of the best places to live in the nation, and with good reason. In addition to a strong educational base, Austin’s expanding health care system rivals that of any major metropolitan area. It is easy to see why Austin ranks in the top spot in national media coverage for best of” listings. Over the past five years. Austin’s trailing 12 month employment growth has seen an annual average increase of 3.80 percent per year (USBLS. Feb ’20).

Tax Benefits

From cost segregation to accelerated and bonus depreciation, real estate enjoys some of the best tax benefits of any investment

Rent

Keep the property to acquire continuous tax-deferred Cash flow. We usually do in house property management through Achieve Properties Property management Company.

Renovation And Construction Management

Our knowledge and understanding of resident needs, balanced with investor expectations, allows us to make physical improvements, add amenities, and provide cost-effective services.

Debt And Equity

Capital markets include real estate valuation, in-depth knowledge of debt markets, and structuring of the investment’s various components.