Are You Ready To Create Long-Lasting Wealth Faster?

Get Access to value add Multifamily Investment Opportunities. Make Money with Cash Flow, Amortization and Appreciation

Join Our Investor Network!

ABOUT Achieve Investment group

Strategy

Identify and acquire value-add multifamily investments with a high return / low-risk ratio. our strategy is to Buy off the Market, Rehab, Rent, Refinance, and Repeat to get the highest ROI.

Specialization

Control the entire investment pipeline such as deals sourcing, property, asset, and construction management. Complete control of the pipeline enables quick turnaround of rehab and Operation.

Acquisitions

We target major MSAs with strong multifamily economic conditions. Class B & C value-add workforce housing properties of 100 units or greater. we target a projected average of cash on cash returns of at least 8 to 10% with an IRR of over 20%.

Execution

We have over 10 years of combined experience in real estate investments. We communicate to our investors monthly once the property is stabilized and rehab is complete, profit is distributed quarterly.

Why Choose MultiFamily Investments

With Achieve Investment Group?

Stability

Real estate investments are less subject to stock market volatility and inflationary risk.

Cash Flow

Real estate investments can generate a stream of income throughout the investment period.

Amortization

Real estate investors own real, physical, cash-producing assets instead of paper, or derivative assets.

Tax Benefits

From cost segregation to accelerated and bonus depreciation, real estate enjoys some of the best tax benefits of any investment

Leverage

Leverage works to your advantage when real estate values rise, but it can also lead to losses if values decline.

Experienced Team

Invest with true multifamily operators (40+ yrs. of combined experience) who led passive investors to an average IRR of more than 20%.

Testimonials From Our Investors

Our Portfolio

DEVELOPMENT PROJECTS

(324 Units)

San Antonio, TX Under Construction

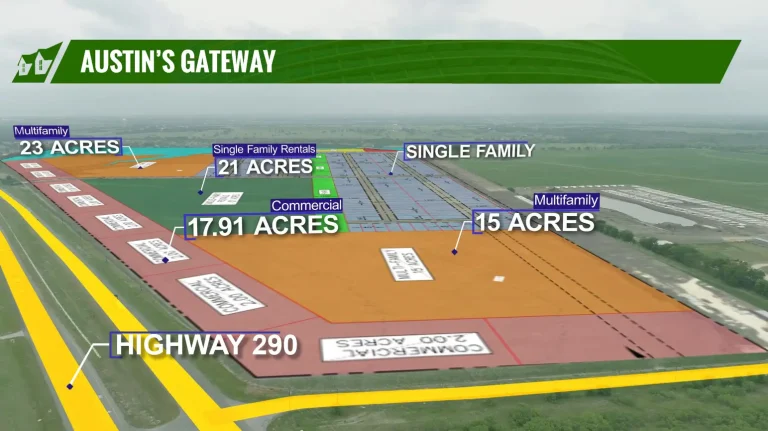

(130 Acers)

Austin, TX Under Land Development

(312 Units)

Converse, San Antonio, TX Fully Entitled

(161 Acres)

Austin, TX Under Land Development

Active Properties

Houston, TX,

United States

5111 Glen Ridge Drive, San Antonio,

TX 78229

2800 W. Hutchins Place, San Antonio,

TX 78224

12200 I-10, San Antonio, TX 78230,

United States

San Antonio, Texas,

United States

San Antonio, TX,

United States

Sold Properties

535 W Hutchins Palm, San Antonio 78221 Holding Period - 4 Years Annual Return

84% Total Return

333%

(174 Units)

San Antonio, TX, United States Holding Period - 5 Years Annual Return

60% Equity Multiple

3.02x

7200 S. Presa St, San Antonio, TX 78223 Holding Period - 3.5 Years Annual Return

50% Equity Multiple

2.7x

2355 Austin Highway San Antonio, TX 78218 Holding Period - 4 Years Annual Return

37% Equity Multiple

2.48x

(115 Units)

6945 Interstate, San Antonio, TX 78213 Holding Period - 4.5 Years Annual Return

34% Equity Multiple

2.55x

(150 Units)

130 Camino De Oro, San Antonio, TX 78224 Holding Period - 4 Years Annual Return

27% Equity Multiple

2.07x

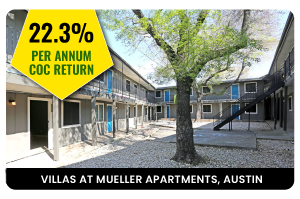

6103 Manor Road, Austin, TX 78723 Holding Period - 3 Years Annual Return

22.3% Total Return

67%

How To Get Started

Our Team

6 PASSIVE INCOME MILLIONAIRES IN 2022!

How We Select Properties

Strategy

Identify and acquire value-add multifamily investments with high return / low risk ratio.

Specialization

Control the entire Investments pipeline such as deals sourcing, Property, Asset and Construction Management.

Acquisitions

Targeting major MSA’s with strong multifamily economic conditions. CLASS A,B, existing and ground-up construction properties of 100 units or greater.

Execution

True multifamily operators (40+ yrs. of combined experience) who led passive investors to an average IRR of more than 20%.

Ready To Get Started?

Frequently Asked Questions

How Do I Get Started Investing With Achieve Investment Group?

from here, you will begin receiving monthly newsletters and deal announcements that will explain what you need to do in order to partner with us on each specific deal.

How Do I Get To Know About Opportunities?

Usually, we host a webinar to announce the new investment opportunities. Join our investor club by signing up above and stay informed about the webinar announcements.