As a savvy commercial real estate investor, you understand the profound impact interest rates have on the industry. With rates fluctuating and

OUR BLOGS

Achieve Wealth Through Value-Add Real Estate Investing!

- Enjoy Weekly Trends

- Get Actionable Insights

- Create Long Term Wealth

- Reap Huge Tax Benefits

- Make Money With Cash Flow

- Capital Preservation With Appreciation

OUR BLOGS

Achieve Wealth Through Value-Add Real Estate Investing!

- Enjoy Weekly Trends

- Get Actionable Insights

- Create Long Term Wealth

- Reap Huge Tax Benefits

- Make Money With Cash Flow

- Capital Preservation With Appreciation

At Achieve Investment Group, our latest project, Istana at Wurzbach, a 324-unit Class A multifamily property in North West San Antonio, marks

Before delving into the broader industry news and updates, I’m excited to provide an update on our project, Istana at Wurzbach. We’re delighted to

As we gear up for another week filled with updates and trends, I’m particularly excited to share something extraordinary with you.I recently

Welcome to our weekly newsletter, where we delve into insightful discussions on real estate trends and investment opportunities. This week, we focus

As we continue our journey towards financial independence and excellence in real estate investment, I wanted to share with you some transformative

As we prepare to dive into this week’s discoveries and insights, I’m excited to kick things off with an exclusive highlight just

A Milestone Worth Celebrating: 25% Returns Amidst the Tide In a world where the real estate currents have been anything but predictable,

Introduction In today’s ever-evolving real estate market, savvy investors constantly seek opportunities that promise solid returns and long-term growth potential. One such

In real estate investment, acquiring multifamily properties has gained significant traction in recent years. As it relates to investing in multifamily properties,

Introduction Real estate syndication is a powerful investment strategy that allows individuals to pool their resources and invest in lucrative real estate

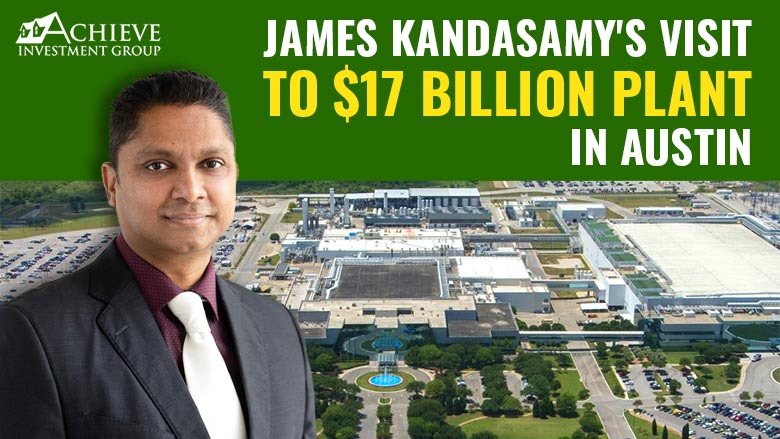

James Kandasamy here, Founder and CEO of Achieve Investment Group. So, guess where I’ve been? Taylor, Texas! I recently visited Samsung’s mammoth $17