James Kandasamy here, Founder and CEO of Achieve Investment Group. So, guess where I’ve been? Taylor, Texas! I recently visited Samsung’s mammoth $17 billion factory, and let me tell you, it’s not just big; it’s MASSIVE! 🏭 Last year, we brought in an investment opportunity right across the street from this colossal location. And wow, did it take off! Investors jumped in so fast that it filled up in just two hours, and we were 3 times oversubscribed.

This Samsung facility is a game-changer, literally transforming the landscape of this small city just north of Austin, Texas. But wait, there’s more to come! There are three more parcels earmarked for development, all with Samsung’s name on them. I even heard from my pals at Samsung that they’re moving more folks to Taylor, Texas, as part of their commitment to the city. They’re on a hiring spree, especially for engineers.

Samsung recently asked for nine additional factories in Taylor. 🏗️ And you know what that means, right? Manufacturing plants are like the golden ticket for job opportunities. They pump cash into the market, creating tons of jobs, both directly and indirectly. That’s Real Estate 101, folks!

Initially, I thought it would take 5-7 years for Taylor to hit the big leagues, but after my visit yesterday, I’m recalculating. I’d say we’re looking at more of a 3-5 year span now.

Wanna get in on deals like this? visit our website at Achieve Investment Group to join our email list. Oh, and by the way, over 5,000 readers tune in to our newsletter every week!

But here’s the kicker: If you’re curious about the full story behind this Samsung investment or want to dive deeper into deals like this, I’ve got a video you won’t want to miss. Hit play and let’s get you clued into the action!

National and State News

Jerome Powell Signals Fed Will Extend Interest-Rate Pause

Federal Reserve Chair Jerome Powell has indicated that the recent surge in long-term Treasury yields may enable the central bank to extend its pause on interest-rate increases, as long as progress on inflation remains on track. Powell’s comments align with those of his colleagues, who have signaled their intention to keep short-term interest rates steady at the next meeting. The rise in long-term rates, which has occurred over the past month, could effectively act as a substitute for further rate hikes if higher borrowing costs persist.

The 10-year Treasury note yields approached 5%, marking a 16-year high and contributing to a decline in stock prices. Powell emphasized the impact of higher bond rates on financial conditions, which is the primary objective of raising interest rates.This increase in long-term interest rates has repercussions for various borrowing costs, from mortgages and auto loans to business debt, with mortgage lenders quoting rates near 8% on the 30-year fixed rate loan, a level last seen in 2000.

While Powell did not explicitly declare an end to rate increases, he acknowledged recent declines in inflation and signs of a cooling labor market, signaling greater comfort with the Fed’s current policy stance. A strong economic outlook makes it challenging for the Fed to halt rate hikes entirely, and Powell refrained from making such a declaration. He noted that it could take a significant change in data to shift the Fed’s stance in that direction.

Powell emphasized the word “could” rather than “would” when discussing the possibility of further tightening of monetary policy, indicating that stronger economic growth might warrant additional tightening. The challenge for Fed officials lies in their forecasting, as economic activity remains robust, but inflation has decreased. The question is whether strong consumer spending will continue to support hiring and economic demand or whether past rate hikes will slow the economy and decrease inflation, necessitating a decision on rate levels. Powell also mentioned that wage growth, a previous concern, appears to be slowing to levels in line with the Fed’s target, reducing the risk of inflation resulting from rising paychecks and prices.

Housing’s Other Threat to the Economy

Residential real estate has probably been boosting growth—but also hurting the economy as a whole

The housing market, despite its role in boosting economic growth, is facing significant challenges that are detrimental to both homeowners and the overall economy. Existing home sales have decreased, largely due to the rapid rise in mortgage rates, making it harder for people to afford homes and discouraging existing homeowners from selling. The limited inventory of existing homes has further exacerbated the situation, resulting in the fewest homes available for sale in September on record. Notably, existing home sales are reported only once they close, making it likely that they were largely financed when mortgage rates were still lower, indicating a potential continued slump in the housing market.

In terms of GDP, existing home sales have limited direct influence, as they contribute relatively little to the economy compared to the building and selling of new homes. Paradoxically, high mortgage rates have supported the sale of new homes due to the scarcity of existing ones, leading to a growth in residential investment and adding to GDP in the third quarter.

While a simplistic assessment might suggest that housing is less sensitive to interest rate increases, the combination of high rates, limited inventory, and low affordability is damaging to the economy. Homeowners, reluctant to move due to high costs, may miss out on opportunities, impacting both their personal well-being and the economy’s growth potential. Additionally, first-time homebuyers are increasingly priced out of the market, with affordability at its worst levels in decades.

Lower interest rates could alleviate some housing market issues by increasing affordability and unlocking inventory, but they won’t fully resolve the problem. Soaring home prices, far outpacing inflation, pose a significant challenge. Addressing these challenges will require a combination of rising incomes and a long-term process, making housing affordability a persistent issue for the economy.

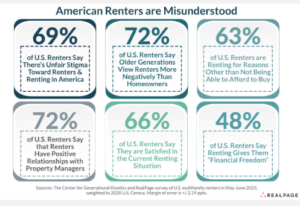

A Majority of U.S. Apartment Renters Feel Satisfied, Despite Stigma

A recent national study conducted by The Center for Generational Kinetics for RealPage reveals that U.S. apartment renters often feel misunderstood, facing societal stigmas rooted in the preference for homeownership. Despite these challenges, the study found that renters are generally satisfied with their apartment homes.

The study highlighted that nearly 70% of renters believe there is an unfair stigma associated with renting in the U.S., with women expressing higher levels of feeling misunderstood, indicating potential gender-related factors in these perceptions. This calls for efforts to challenge stereotypes and foster a more inclusive environment.

There is a generational divide in these perceptions, as 73% of renters believe that older generations view renters more negatively than homeowners, emphasizing the importance of intergenerational dialogue.

Surprisingly, the study found that 63% of renters choose to rent for reasons other than financial constraints, challenging the common assumption that renters are primarily driven by affordability concerns. Positive relationships with property managers were also a highlight, with 72% of renters reporting favorable interactions.

Despite the sense of being misunderstood and societal stigmas, 66% of renters expressed satisfaction with their current living situation. Furthermore, roughly 48% of American renters believe that renting provides them with financial freedom, indicating that renting is not solely an affordability-driven choice but can also be a strategic decision for a significant portion of the population. These findings offer valuable insights for apartment owners and operators seeking to better understand and cater to the needs and preferences of renters.

A reorganization of the massive bureaucracy that oversees health care for the Defense Department could add several hundred jobs to its already sizable presence in San Antonio. Although the department’s D.C.-area headquarters isn’t going anywhere, Breen said “elements of the headquarters … will probably relocate” to San Antonio. We don’t know which ones yet.” With more than 3,440 people across 22 San Antonio-area facilities, the agency’s staffing here is already bigger than the 2,700 who work at its HQ. But job gains are expected to come along with a planned consolidation of its area operations.

Peter Graves, another agency spokesman, put a number on it.

The reorganization comes a decade after the Defense Health Agency was created to serve the Air Force, Army, and Navy. Since then, its footprint in San Antonio has expanded and employment more than tripled. Off base, about 1,000 health agency staffers now work at three sites located downtown, at Port San Antonio, and on the Northwest Side.