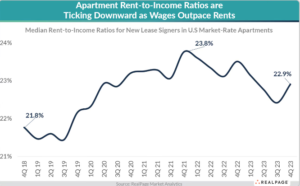

Welcome to our weekly newsletter, where we delve into insightful discussions on real estate trends and investment opportunities. This week, we focus on the Rent-to-income ratio of 22.9% in the 4th quarter of 2023 is down 90 basis points (bps) from the peak and down 60 bps year-over-year

Here’s some good news: Apartment rent-to-income ratios declined in 2023 as incomes grew faster than rents. The median U.S. household signing a new lease for a market-rate apartment came in with a rent-to-income ratio of 22.9% in the 4th quarter of 2023, down 90 basis points (bps) from the peak and down 60 bps year-over-year, according to data from RealPage Market Analytics.

In fairness, rent-to-income ratios remain slightly above the pre-COVID norms of around 22%, given that rents outpaced wages during the peak inflationary period.

But market-rate apartment affordability is steadily improving thanks to the onslaught of new supply cooling off rent growth, even as wages keep rising. This is good news for renters AND operators.

PREMIUM CONTENT

As income growth begins to outstrip rent increases, we observe a broadening interest in rental properties across all price tiers. This positive shift is anticipated to persist into 2024, bolstered by an influx of new rental listings and expectations for rent hikes to remain subdued.

Many inquire about the methodology behind these findings whenever I present this data. Our analysis aligns with the standards commonly adopted by Real Estate Investment Trusts (REITs), where affordability metrics typically fall within the low to mid-20% range, echoing our results. We assess affordability by examining the combined income of all individuals listed on a lease application, including roommates, against the agreed-upon rent. From this, we calculate the rent-to-income ratio for each household and determine the median value across the dataset. It’s important to note, this calculation excludes lease renewals, as income information is not commonly re-reported at these times.

But in most professionally managed, market-rate rentals, operators typically will not lease to renters with rent-to-income ratios of 30%+. And yet there’s been enormous demand in recent years for market-rate rentals among renter households spending 22-23% of income toward rent.

But broadly speaking, affordability is not the massive headwind it’s often portrayed to be… and it’s now trending in the right direction.