Passive Investors from Houston Multifamily Foreclosure

As the whole Multifamily Industry knows, there was a foreclosure of 3200 Units with $229 million of debt in Houston by Arbor Realty from a private Deal Sponsor from Dallas. These properties were bought between August 2021 and April 2022. The Deal Sponsor defaulted on their mortgage payment. The investors from that deal have alerted their friends about the potential foreclosure two weeks before it came out on Twitter .

This news eventually came out in Wall Street Journal. As per Trepp Inc, these properties’ cash flow went from 3.8% to more than 8% due to the rapid interest rate hike by FED. While the interest rate hike by the Fed has caused this property to be further under distress, many other factors have caused these Deal Sponsors to face foreclosure. We have a written 10-series article that we wrote so that any passive investor can learn and avoid investing in this kind of Deal Sponsors.

Bridge Loan with No Rate Caps

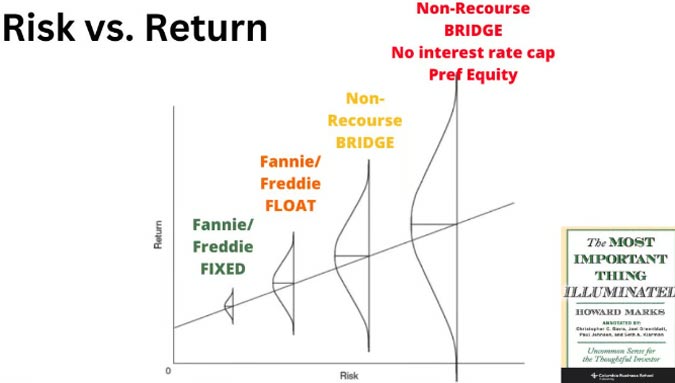

As per the chart below from Howard Mark’s book “The Most Important Thing”, Non-Recourse Bridge Loan stacked with Preferred equity without a rate cap.

As you can see it’s considered the highest risk deal type.

Preferred equity is a private institutional group that acts like a lender but holds a second position in the capital stack. Preferred equity usually charges a fixed 12-14% interest rate with 1%-2% when the deal is initiated and exited. Usually, preferred equity is used behind common equity (normal retail investors) to boost back-end profit. It’s also used when the sponsor can’t raise a large sum of equity from retail investors. The pitch to the investor is the deal has a lot f upside that even after paying the fixed return to the pref equity group, there will be a lot more upside to common equity. I attended a webinar where the presenter declared using preferred equity is the way to do deals in 2021.

To survive market fluctuations an operator needs to be disciplined and stick to their stringent underwriting criteria. However, when the buying spree seems to be forever, many operators start to do deals at any cost. This includes taking Bridge loans for a deal that does not have significant value-add. I call it a misuse of loan type. I see many cash-flowing deals with thin upsides were bought using bridge loans. Of course, when the Deal sponsor raises the capital, they declare their deals are value add. The question is how big is the upside? In the worst case, some Deal Sponsors did not even take a rate cap insurance.

After the year 2020 to mid-2022, the value of the multifamily assets has gone beyond its intrinsic value. Fannie Mae and Freddie Mac lenders have almost gone out of business as the only way to make any deal work is to get a bridge loan since it’s a forward-looking upside loan. Furthermore, many Deal sponsors didn’t realize that the rate is variable. When the interest rate skyrockets, most of them are caught unprepared. The smarter and more conservative one invested in rate caps insurance since it was affordable then. The aggressive or less sophisticated Deal Sponsors decided not to buy rate caps due to ignorance or they even can’t raise the capital for equity. Most lenders will require rate cap purchases as a mandatory requirement. In the Houston Foreclosure case, looks like the lender didn’t require the sponsors to buy rate caps. Furthermore, Bridge loans were used for Deals that is not for value add.

At Achieve Investment Group, James Kandasamy Texas, we are proud to say that we only have 1 bridge loan (with a rate cap of course) out of our 15 multifamily deals that we have and have done. Even that bridge loan is a true Deep value add deal. We could have done many more deals from 2020 to 2022 by taking Bridge Loans for all kinds of think upside deals as many passive investor capital were easily available. We were well aware that Bridge loans pose risk and need to be used appropriately for true-value add deals. I wrote about this on page 68 of my 2019 Bestselling Book “Passive Investing in Commercial Estate”.

Action Item for Passive Investors

For passive investors, it is important to consider passive real estate investing as a potential option, Make a list of your investment to identify bridge loans, whether there are rate caps, when the rate cap expires, and whether the deal has a preferred equity between You (common equity) and the Senior Lender. I am sure you will be surprised!