Are you aware that you can make a difference and earn potentially lucrative returns at the same time? It’s a common fallacy that investing and aiding others are mutually exclusive, but that’s not the case.

Opportunity Zones, are an incredible economic tool that allows you to contribute to positive change in under-invested neighborhoods all over the U.S., and simultaneously qualify for some impressive tax benefits.

Opportunity Zones emerged from the Tax Cuts and Jobs Act in 2017. These economically disadvantaged areas throughout the United States have been designated for investment and economic development. The incentives include significant tax benefits, attracting real estate investors in large numbers.

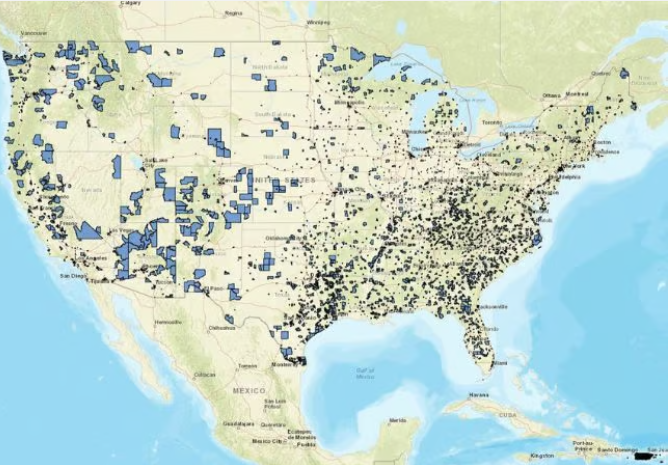

Click On The Map To See The Current Opportunity Zones

Are you looking to invest in Opportunity Zones? Simply submit your response to express your interest and we’ll keep you in the loop.

Here’s how you can tap into the potential of Opportunity Zones:

By holding onto your Opportunity Zone investment for five years, you could see a reduction in your capital gains liability by 10%. Hold on for two more years, and that reduction jumps to 15%. Patience truly is a virtue!

**Capital Gains Deferral:**

Reinvest your capital gains into an Opportunity Zone fund within 180 days and you can defer the tax on those gains. This tactic allows you to use your gains to fund more investments.

**Enjoy Tax-Free Growth:**

This is where it gets really interesting. If you hold onto your Opportunity Zone investment for a full decade, any appreciation on that investment becomes completely tax-free. Yes, you read that right. Your gains can be realized without any extra tax liability.

**Diversify Your Portfolio:**

From real estate development to infrastructure projects and operating businesses, Opportunity Zones offer a multitude of investment opportunities. Choose investments that align with your interests while enjoying the tax benefits.

**Due Diligence is Key:**

To maximize your benefits, you’ll need to do your homework on your chosen Opportunity Zone and its economic prospects. Understanding the local market dynamics is crucial for making informed decisions.

Investment in Opportunity Zones represents an exciting way to combine impact investing and tax benefits. It’s a win-win.

Interested in investing in Opportunity Zones? Simply fill out our submission form to express your interest and we’ll keep you in the loop.