Understanding Real Estate Market Cycles

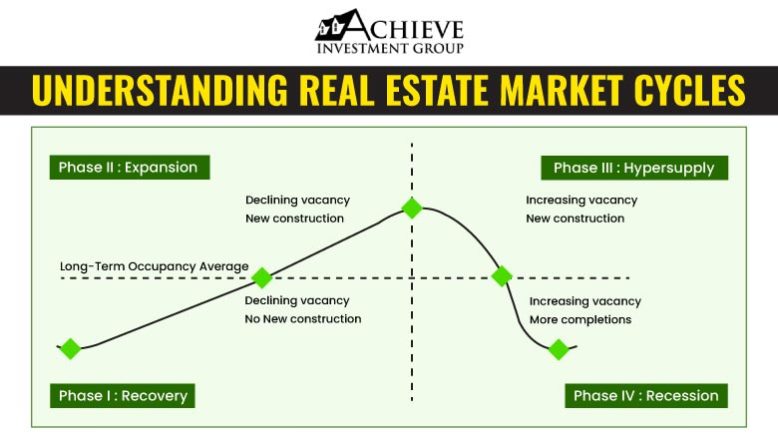

As the financial markets continue to be uncertain, investors are trying to predict where the economy is headed. While even the savviest investors cannot forecast the market, it is essential to understand demand drivers impacting the economy and how that could affect real estate fundamentals. In addition, individual investors may consider implementing various strategies to increase returns and mitigate risk during these specific timeframes. Since real estate investing may be new to some investors, we will explain how real estate market cycles work, why they are critical to understanding, and how they are affected by such factors as interest rates, economic vitality, and government subsidies. Rental behavior within each of the phases is described by Dr. Mueller, who uses varying Market Levels ranging from 1 to 16. Equilibrium is reached at Market Level 11, where demand growth equals supply growth – the sweet spot. The equilibrium Market Level 11 is also the peak occupancy level. The four phases of market cycles: Phase 1 – Recovery – Declining Vacancy, No New Construction 1-3 Negative Rental Growth 4-6 Below Inflation Rental Growth Phase 2 – Expansion – Declining Vacancy, New Construction 6-8 Rents Rise Rapidly Toward New Construction Levels 8-11 High Rent Growth in Tight Market Phase 3 – Hypersupply – Increasing Vacancy, New Construction 11-14 Rent Growth Positive But Declining Phase 4 – Recession – Increasing Vacancy, More Completions 14-16, then back to 1: Below Inflation, Negative Rent Growth Where and how to invest during this economic downturn? Dr. Mueller’s Real Estate Market Cycle Monitor has been tracking each primary commercial real estate sector since 1990. He presents his nationally acclaimed “Real Estate Market Cycles” report. His analysis helps investors identify where various markets are in the four phases of the real estate cycle and ultimately decide where and when to invest in this economic downturn. WATCH THE FULL WEBINAR Join our investor list to access our current and upcoming investment opportunities.