Our Boston Woods investment was located a short 10 min drive from the Medical Center in San Antonio, TX at Intersection 110 and Loop 410. We were able to find this deal using an off-market strategy, reaching out to the sellers directly. Using an off-market strategy in procuring a deal can help make it a more advantageous investment. It is comprised of 174 originally split into 3 locations: FKA Cumberland, Villa Madrid, and Westchester. Constructed originally in 1970, 1974, and 1984 respectively. We combined the three properties into one – Boston Woods.

Purchasing deals at the market cap rate can be a great investment as long as there is a value-add component, which in this case there clearly was. Our decision to merge the three properties into one not only streamlined this property- but was a huge marketing advantage as well.

Acquisition

- Purchased in November 2016, 6.51% cap rate

- Cash out of pocket: $3.76 million

- Initial Financing: $4.66 million at 4.61%

- Capital Repairs: $1.52 million

Purchasing deals at the market cap rate can be a great investment as long as there is a value-add component, which in this case there clearly was. Our decision to merge the three properties into one not only streamlined this property- but was a huge marketing advantage as well.

How Did We Find the Deal?

Off Market Strategy

- Using text blast campaign to Sellers.

- Negotiated with Sellers for almost 8 months.

- Sellers are partners with bad relationships.

- Sellers are sophisticated Land developers/brokers

Learn to Find Deals using an Off-Market Strategy

Previous Management Marketing Issue

Top three Largest PM companies in San Antonio

- Right strategy Managing Three Properties as One

- Horrible marketing with phone greetings with 3 different names.

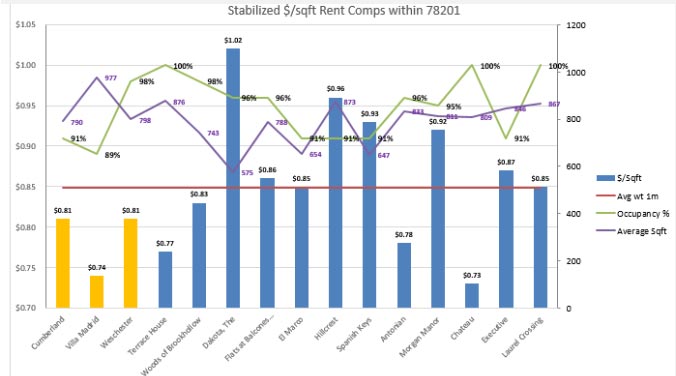

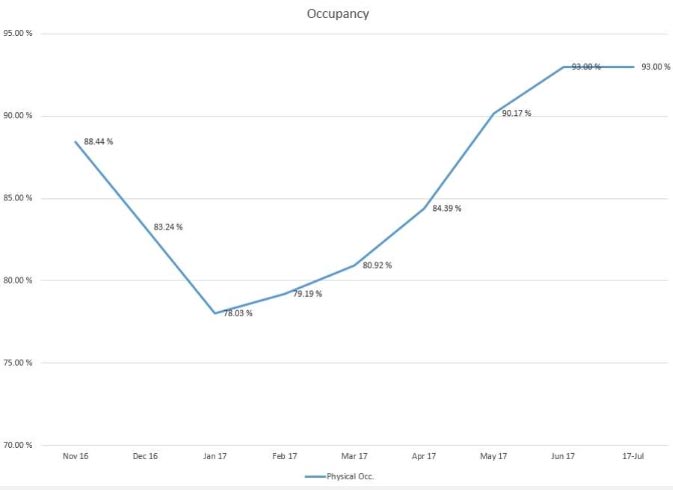

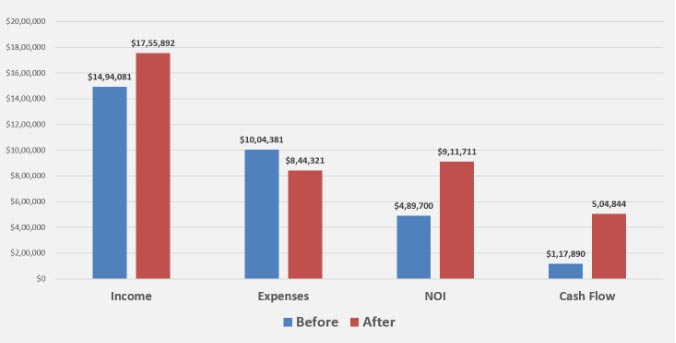

We increased rental income from $.75/sq. foot to $.92/sq. foot. We utilized multiple crews for the rehab, implementing a partial rehab plus full rehab strategy to slow resident turnover and keep tenant occupancy up throughout the process.

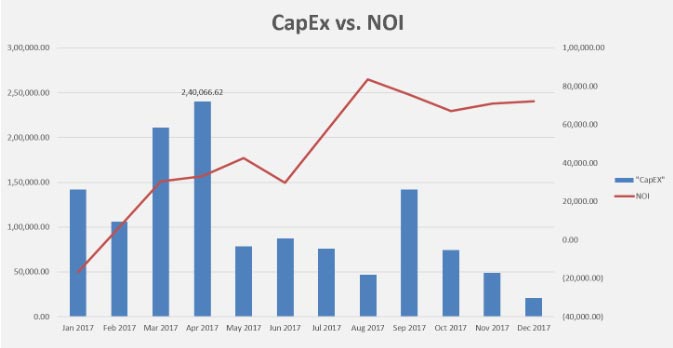

We spent $1.3 million within 12 months of acquiring this property with a total budget of $1.5 million. It’s important to pump capital into the property ASAP to increase valuation. By doing this we were able to quickly convert $1.3 million cash in the bank to $75k NOI – a 50% increase.

At the end of this project:

- We increased rent by $130 per door

- Reduced expenses from 67% to 48%

- NOI increase of 86%- with a value increase from $6.9 mil to $13 mil

- Cash flow increased 7/8% based on the initial investment

- Altogether an INCREDIBLE 117% return from Initial Investment!