Publications

Passive Real Estate Investors Need To Know This Before Filing Their Taxes!

Essential Tax Planning Tips And Strategies Before April 15th With Nationally-recognized CPAs And Tax Strategists “Amanda Han” and “Matt Macfarland”

Economic Forecast and Commercial Real Estate Outlook For 2023

Commercial Real Estate State of the Union in Post Election Era with Chief Economist K. C. Conway

Should You Invest In Commercial Real Estate Right Now?

Should You Invest In Commercial Real Estate Right Now? With Real Estate Market Cycle Expert Dr. Glenn Mueller And Cre Best-selling Author James Kandasamy

As Interest Rates Climb, What happens to Rental Property’s Bottom Line?

2022 has brought about some of the highest rates from the Fed in the past 40 years. Which brings about many questions for real estate investors. Will this push us into a recession? What will this mean for the housing market, mortgage rates, and rental investments? To start; as rates increase it’s important to bear in mind that investment loan rates will always be higher than a traditional mortgage to begin with. As a general rule of thumb, you can expect investment loan rates to be approximately 0.50% to 0.75% higher than a primary mortgage rate. In our current market, both home prices AND financing prices are on the rise simultaneously. Which means that people aren’t just being pushed into a less expensive home, some are pushed out of purchasing a home altogether. So, what do they do? They continue renting. Rental markets and the home purchase market are very tightly linked. Therefore, we can determine based on historical data in similar market climates, the coming years will have a large and increasing market of renters. Making having a real estate investment a wise one indeed. The demand for housing will remain high and along with that, high rent prices. This recent Zillow report shows how increased mortgage rates correlate with average rents, moving from $1,600 per month in February 2022 to $2,000 in August 2022. Source: Zillow Economic Research So what does this mean for Rental Property Owners or those involved as passive Real Estate Investors? The bottom line is that when the Federal Reserve interest rates go up, it can actually be a very good thing for real estate investors, particularly multi-family. The first reason is that the market for multifamily apartments will increase as many people will either not qualify or cannot afford a mortgage on a primary residence. The standards for lending go up significantly during this climate of rates increasing. Mortgage lenders who previously pre-qualified home shoppers will have to recalculate, often leaving a lower number of qualified home buyers. The second thing to consider is that while the housing market boom appears to have stabilized, the prices of homes remain at historic highs. Coupling that with the rising interest rates results in rental costs being favored over a mortgage payment. Therefore indicating that real estate investments will continue to perform well. Individuals and families now postponing house hunting still need a place to live. The market for tenants now looking for a place to rent is bigger and will expectedly climb. When you piece together what a rising Federal Reserve rate does to the housing market and mortgage rates- it may signal a great opportunity for potential investors to dip their toe into the real estate investment market or for those already in the game to consider expanding their holdings. The foreseeable future holds a new stream of tenants and a strong future for real estate investment. Historically real estate has always been a strong hedge against inflation. To learn more about our current passive investment opportunities, please Schedule an investor introductory session

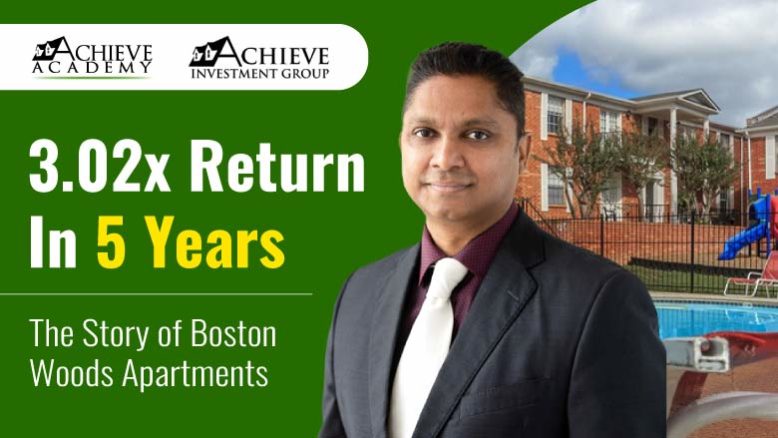

3.02* Return in 5 Years – Story of Boston Wood Apartment

Our Boston Woods investment was located a short 10 min drive from the Medical Center in San Antonio, TX at Intersection 110 and Loop 410. We were able to find this deal using an off-market strategy, reaching out to the sellers directly. Using an off-market strategy in procuring a deal can help make it a more advantageous investment. It is comprised of 174 originally split into 3 locations: FKA Cumberland, Villa Madrid, and Westchester. Constructed originally in 1970, 1974, and 1984 respectively. We combined the three properties into one – Boston Woods. Purchasing deals at the market cap rate can be a great investment as long as there is a value-add component, which in this case there clearly was. Our decision to merge the three properties into one not only streamlined this property- but was a huge marketing advantage as well. Acquisition Purchased in November 2016, 6.51% cap rate Cash out of pocket: $3.76 million Initial Financing: $4.66 million at 4.61% Capital Repairs: $1.52 million Purchasing deals at the market cap rate can be a great investment as long as there is a value-add component, which in this case there clearly was. Our decision to merge the three properties into one not only streamlined this property- but was a huge marketing advantage as well. How Did We Find the Deal? Off Market Strategy Using text blast campaign to Sellers. Negotiated with Sellers for almost 8 months. Sellers are partners with bad relationships. Sellers are sophisticated Land developers/brokers Learn to Find Deals using an Off-Market Strategy Previous Management Marketing Issue Top three Largest PM companies in San Antonio Right strategy Managing Three Properties as One Horrible marketing with phone greetings with 3 different names. We increased rental income from $.75/sq. foot to $.92/sq. foot. We utilized multiple crews for the rehab, implementing a partial rehab plus full rehab strategy to slow resident turnover and keep tenant occupancy up throughout the process. We spent $1.3 million within 12 months of acquiring this property with a total budget of $1.5 million. It’s important to pump capital into the property ASAP to increase valuation. By doing this we were able to quickly convert $1.3 million cash in the bank to $75k NOI – a 50% increase. At the end of this project: We increased rent by $130 per door Reduced expenses from 67% to 48% NOI increase of 86%- with a value increase from $6.9 mil to $13 mil Cash flow increased 7/8% based on the initial investment Altogether an INCREDIBLE 117% return from Initial Investment! Boston Woods is a prime example of Achieve’s focused strategy, skillful execution, and top-tier returns. Key takeaways from this investment include strategies of off-market acquisition, choosing a property with a value-add component, choosing to name the property with a marketing advantage, using a near-to-far rent comp, having multiple crews for the rehab- utilizing a partial plus full rehab to keep occupation and rent up during the process.

Austin Housing Market Predictions 2022-23

The Austin housing market is shifting. The market reflects what is happening in other major cities across the country. While activity appears to have slowed slightly in recent months, home prices in Austin are still on the rise. Home values are over 13% higher than they were in June 2021, when compared with historical averages of 5-6%. As a result, the Austin real estate market is exhibiting indications of slowing down. However, it should be noted that fewer homes are being sold than in previous years. The trend of a slowing growth rate in sales indicates market stabilization, but the demand is still outpacing the supply in a market where housing prices have reached all-time highs. As a result, Austin home prices are skyrocketing, and buyers are bearing the brunt of the burden. Low inventory, high buyer demand, and rising prices will continue throughout the year; however, there are signs that the market will eventually cool off when inventory rises or prices reach their apex. The median sales price is surging in double digits and will continue to rise over the next twelve months. The Austin Board of REALTORS®‘ Mid-Year 2022 Central Texas Housing Market Report shows that a triple-digit gain in active listings year over year pushed housing inventory levels over 2 months. The market is moving towards pre-pandemic sales activity and inventory. The Austin market is not balanced, and it still favors sellers. Homes still closed at over 100% of the list price on average in June. Residential home sales declined 20.3% year over year. There is an influx of homes on the market. The median price rose 13%, setting a record of $537,475. New listings jumped 19.6% to 6,160. Housing inventory increased to 2.1 months of inventory, up 1.5 months from last June — a sign of a seller’s real estate market. Austin Housing Market Predictions 2022-23 Austin’s housing market is likely to continue the trend of recent years as one of the hottest markets in the nation. The biggest drivers of residential real estate demand are Austin’s economy, which has diversified and strengthened over the past two decades, and companies like Google and Tesla moving operations here. As more companies move here, that means more people looking for homes, and Austin is also attractive to outside investors. With a steady influx of job creation in the pipeline, the housing market will continue to post strong numbers well into 2022. Big companies moving here will also play into what happens to the housing market.Corporate relocations are at an all-time high and the housing demand is rising rapidly. Because of this, the supply cannot meet the demand, and this region has a higher probability of withstanding economic downturns.According to their report, the value of the Austin Metro housing market grew by $141 billion or 126% in the past decade. In 2010, the market was worth about $111 Billion. In 2019, Austin’s total housing value grew $22 billion or 9.5%, year-over-year.NeighborhoodScout’s data shows that real estate in Austin has appreciated 169.47 percent over the last ten years, which is an average annual home appreciation rate of 10.42%. This figure puts Austin in the top 10% nationally for real estate appreciation. During the latest twelve months, Austin’s appreciation rate was 26.34%.According to the Zillow Home Value Forecast (ZHVF), Austin-Round Rock Metro’s home values have gone up 25.2% over the past year and are expected to rise by 7% by June 2023. Austin High Rise Deal Coming Soon..!!! Stay Tuned for more updates. If you would like to be notified of our future opportunities, please join our investor network below. Join Our Investor List