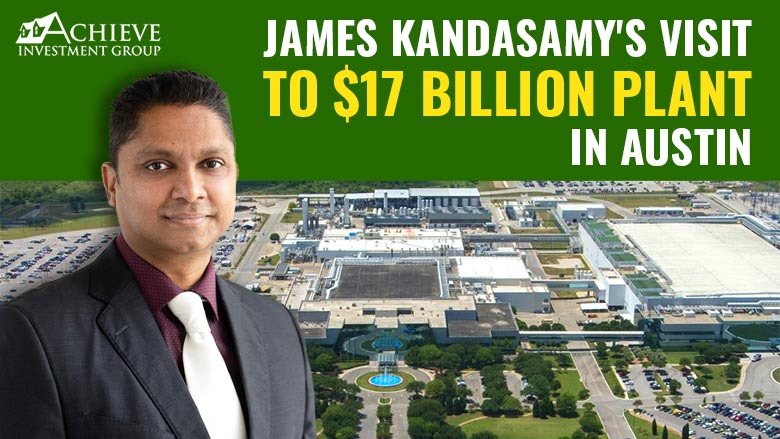

James Kandasamy’s Visit To $17 Billion Plant in Austin

James Kandasamy here, Founder and CEO of Achieve Investment Group. So, guess where I’ve been? Taylor, Texas! I recently visited Samsung’s mammoth $17 billion factory, and let me tell you, it’s not just big; it’s MASSIVE! 🏭 Last year, we brought in an investment opportunity right across the street from this colossal location. And wow, did it … Read more